Crypto researcher Julien Bittel has revealed that the Bitcoin cycle top has yet to happen, providing a bullish outlook for the flagship crypto. Instead, BTC just looks set to enter its most parabolic phase, eyeing new highs.

Bitcoin Cycle Top Metric Yet To Be Triggered

In an X post, Bittel alluded to the ‘GMI Bitcoin Cycle Top Finder’ to prove that this cycle is far from over. He noted that the indicator has correctly spotted four top signals in Bitcoin’s history, and they each corresponded to a top for the flagship crypto. However, this time around, the indicator shows that BTC is nowhere near a cycle top.

His accompanying chart also suggested that Bitcoin still has a long way to go in this cycle before it reaches a cycle top. This is bullish for the flagship crypto as it indicates that it still has more than enough upside to break through its current all-time high (ATH) of $111,900. It is worth mentioning that Bittel’s post was in response to crypto analyst TechDev, who also confirmed that the cycle isn’t over.

In an X post, TechDev revealed that a launch signal, not a top signal, has appeared for Bitcoin. He noted that there have been launch signals in BTC’s history, and each of them sent the flagship crypto on a parabolic run. This launch signal has again triggered, with a massive rally potentially on the horizon for the BTC price.

Crypto analyst Rekt Capital also recently confirmed that the Bitcoin cycle top isn’t yet in. However, he warned that another bear market will happen at some point. He stated that people think BTC will never see another bear market because it is now mainstream and too mature an asset. He added that this bear market will likely occur again after this bull market.

BTC to Still Reach $200k This Year

Asset manager Bitwise has maintained that the Bitcoin price can still reach $200,000 this year. They stated that they are holding firm to this prediction, as there is simply too much institutional demand for BTC to keep prices flat for long. This demand has occurred through the Bitcoin ETFs, which continue to record massive inflows. At the same time, several companies are adopting Strategy’s playbook of creating a BTC treasury.

Standard Chartered has also predicted that the Bitcoin price can reach $200,000 by year-end. The bank believes that ETF inflows and corporate demand for BTC will spark the rally to this target. They also alluded to Powell’s potential early exit and the passing of the stablecoin bill as other factors that could serve as catalysts for this rally.

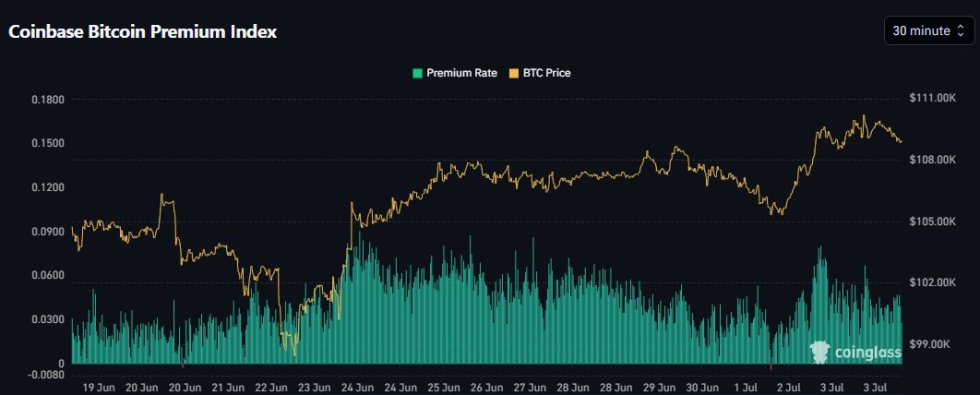

At the time of writing, the Bitcoin price is trading at around $108,265, down in the last 24 hours, according to data from CoinMarketCap.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments