Key Takeaways:

- OpenAI denies any involvement in Robinhood’s new tokenized stock offering and warns users of risks.

- Robinhood’s tokens offer no actual equity or rights—just price-linked exposure via blockchain contracts.

- Critics question the product’s legality, transparency, and whether it truly benefits retail investors.

Trading platform Robinhood has ignited controversy in the crypto space after announcing the launch of tokenized stock giveaways tied to OpenAI and SpaceX, two of the most talked-about private tech companies in the world. But the excitement quickly turned into a firestorm as OpenAI issued a firm denial, stating that the tokens do not represent equity and were launched without its consent.

The backlash is fueling heated debates about the limits of tokenization, investor protections in crypto, and how far platforms can go in mimicking exposure to high-profile companies without formal partnerships.

Read More: Robinhood Launches Micro Crypto Futures, Unlocking XRP and Solana for Small Traders

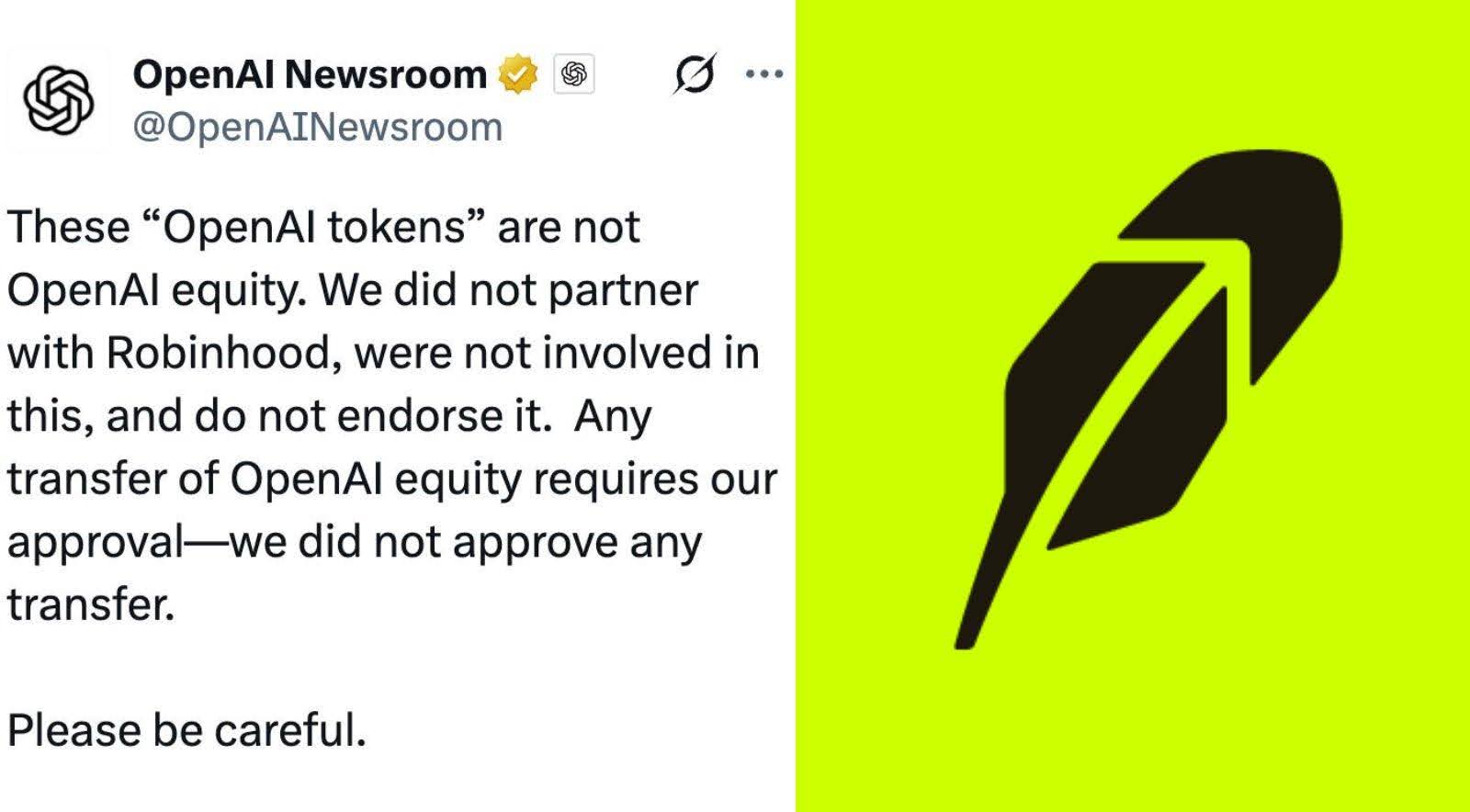

OpenAI Disavows Tokenized Stock Tied to Its Name

Just hours after Robinhood announced its Ethereum-based tokenized stock products, OpenAI posted a public warning on X (formerly Twitter), making clear that no equity transfer had been approved and that it had not partnered with Robinhood in any way.

“These ‘OpenAI tokens’ are not OpenAI equity,” the company wrote. “We did not partner with Robinhood, were not involved in this, and do not endorse it.”

This sharp statement signals a fundamental dispute over how tokenization is being used. OpenAI’s warning was soon echoed by Elon Musk, who bluntly responded, “Your ‘equity’ is fake,” emphasizing the growing unease around what exactly Robinhood is selling.

Read More: Sam Altman’s Eye-scanning Crypto Project “World” Launches in Six U.S. Cities

Robinhood Pushes “Synthetic Exposure” to Private Companies

Robinhood claims its new tokens offer investors indirect access to private markets through a Special Purpose Vehicle (SPV) structure. These blockchain-based contracts are hosted on Arbitrum, an Ethereum layer-2 network known for high-speed, low-cost transactions.

“These tokens give retail investors indirect exposure to private markets,” a Robinhood spokesperson said, clarifying that they do not confer ownership, voting rights, or dividends.

Instead, users are purchasing a digital representation that tracks the estimated valuation of companies like OpenAI or SpaceX. The price of each token is tied to secondary market appraisals and displayed in USD, though Robinhood also stated that U.S. residents are barred from trading the assets due to regulatory restrictions.

While some investors argue that digital certificates are just as valid as paper shares, legal experts and critics warn that the product lacks transparency, real asset backing, and legal clarity—especially under U.S. securities law.

Legal Experts Warn of Regulatory Trouble

SEC Scrutiny Looms Over Tokenized Equity Play

According to Kurt Watkins, founder of U.S.-based Watkins Legal, Robinhood’s offering would likely face serious SEC scrutiny if launched in the U.S.

“There is no guarantee the tokens will actually track OpenAI’s price since they lack meaningful underlying rights and could face liquidity issues,” Watkins said.

He added that the opaque structure of the SPV behind the tokenized equity could trigger Howey Test implications, exposing the product to classification as an unregistered security. This would require a formal registration process with far more robust disclosures than what Robinhood currently provides.

“The product could be considered misleading and commercially unviable in the U.S.,” he concluded.

Watkins’ concerns echo a broader regulatory theme: when platforms tokenize assets without consent, clear rights, or legal structure, it undermines the very investor protections securities laws are built to uphold.

DeFi Community Pushes Back Against Centralized Tokenization

Robinhood has framed its tokenization efforts as a step toward democratizing access to previously restricted financial products. But DeFi developers and analysts are pushing back, saying the execution does not align with core crypto principles of openness, decentralization, and composability.

“Just decompiled Robinhood’s tokenized stock contracts,” tweeted Ren, a partner at Electric Capital. “It’s a walled garden. Every transfer checks a registry of approved wallets (KYC/AML).”

This means Robinhood’s tokenized assets can’t interact with DeFi protocols, such as decentralized exchanges or lending markets, because of tight restrictions and centralized controls. This “pseudo-DeFi” model, Ren continued, could provide centralized platforms an unfair advantage – not by innovation, but by controlling access and distribution.

The post OpenAI Denies Involvement in Robinhood’s Controversial Tokenized Stock Launch appeared first on CryptoNinjas.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments